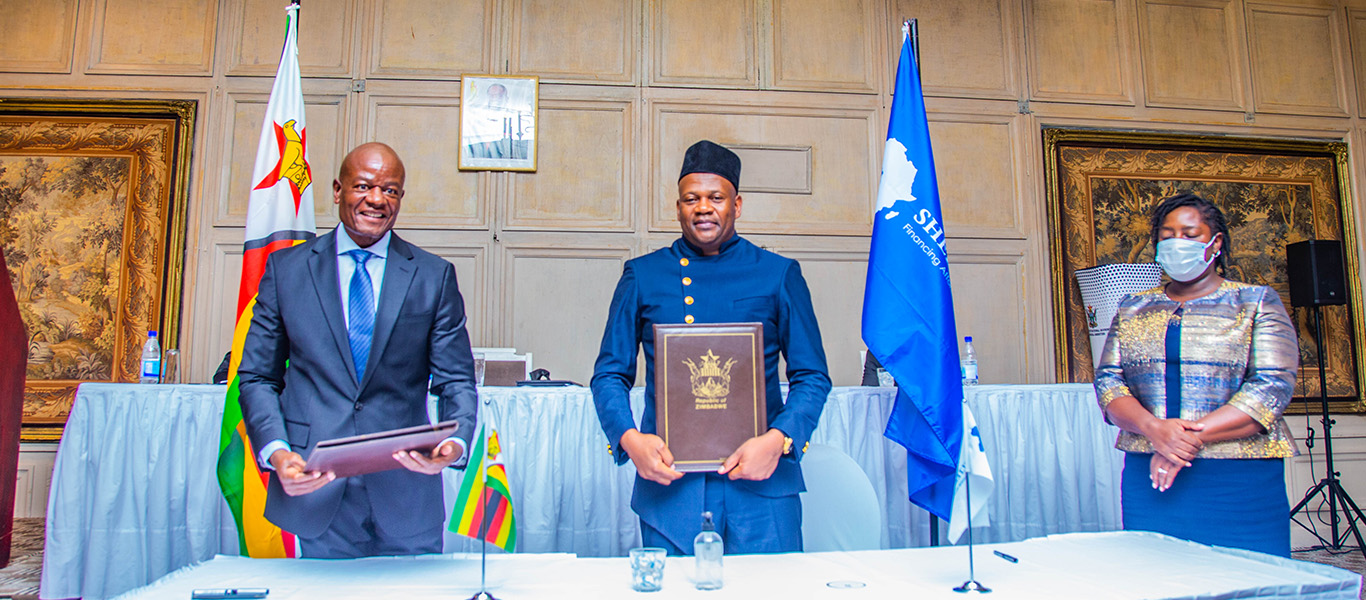

Shelter Afrique Appoints New Chief Executive Officer

– Mr. Theirno Habib brings to the Company more than 20-years experience in housing finance, capital markets and structured finance.

Nairobi, Kenya: 15 August, 2022

Nairobi-based pan African housing development financier Shelter Afrique has appointed Thierno-Habib Hann as the new Chief Executive Officer to succeed Mr. Andrew Chimphondah who left the company early this year.

Mr. Hann currently serves as the Asia/Pacific Lead for housing finance at the International Finance Corporation (IFC), based in Bangkok, where he leads the strategy development and implementation of the housing finance program with a portfolio of over USD 2 billion.

He previously held a similar position, in charge of Africa and the Middle East, based in Nairobi.

Commenting on the appointment, Shelter Afrique Chairman Mr. Ephraim Bichetero said the selection process was very competitive, based on merit and competence.

“Mr. Hann has extensive international experience in housing finance, capital markets and structured finance, set-up and management of investment funds with banking and multilateral institutions, spanning over 20 years. He brings with him a wealth of leadership experience in development and investment, sharp insight in real estate landscape and a strong track record of delivery. Over the years, he has developed housing finance transactions in the US, Latin America and Eastern Europe, valued over USD 32 billion,” Mr. Bichetero said.

“He is expected to strengthen governance, be an embodiment of our values and drive the investment strategy of the Company focused on delivering large-scale affordable housing,” He added.

Welcoming his appointment, Mr. Hann said he was excited at the opportunity to lead Shelter Afrique through its next face of growth.

“I’m happy and honoured to take on the new role at Shelter Afrique, particularly as many African countries face significant turning point in their housing agenda. It is an honour to lead this team at this critical moment and together we will work towards harnessing national resources to improve local populations’ living conditions and to achieve Shelter Afrique’s mandate,” Mr. Hann said.

Hann began his career at the consulting firm Arthur Andersen, LLC as a Senior Consultant in Financial Services and Capital Markets in New York City.

LHe has worked at JPMorgan Chase and Goldman Sachs as Manager and Vice President respectively and led investment teams issuing mortgage-backed securities (RMBS/CMO), credit derivatives (CDS) in these organizations.

He also served at the World Bank Group as the Private Sector Development Program Manager in Guinea, responsible for designing and implementing the business climate improvement program, while developing a bankable pipeline of investments and government advisory projects in strategic sectors of the economy.

Habib holds an MBA in Finance & Investments from the Zicklin School of Business, Bernard Baruch, New York City; a master’s degree in Accounting and Finance (M.S.T.C.F) and a bachelor’s degree in Management and Applied Economics (GEA), from Paris IX Dauphine University, with honors.

A native of Guinea (Conakry), Hann is the co-founder of “AngelAfrica” – a pan African investment platform formed to achieve economic prosperity on the continent by building and fostering innovative technological ideas, investors and business mentors.

Mr. Hann will join the organization at the end of his current contract with IFC. In the interim Mr. Muwowo will continue to serve as Acting Managing Director.