Shelter Afrique the Pan-African finance institution exclusively supporting the development of the housing and real estate sector in Africa signed an MOU (Memorandum of Understanding) with CITIC Construction, one of the biggest multinational construction and engineering companies and IFC, the International Finance Company. The new partners envision funding large scale affordable housing projects in the sub-Saharan African region.

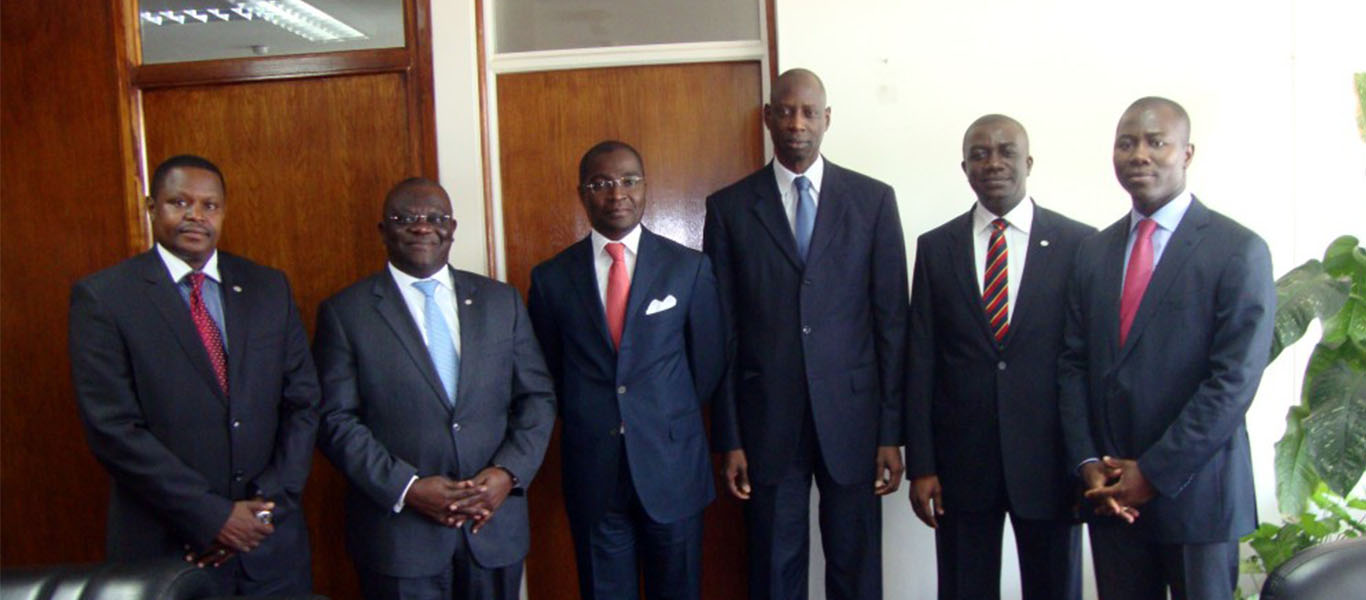

The agreement which is expected to boost Shelter Afrique quest in providing housing for all, was signed by the Managing Director of Shelter Afrique, Mr. Alassane Ba; Vice President of CITICC, Mr. Mingguang Xu and the Head of IFC in the East Africa Region, Mr. Manuel Moses.

The MOU’s objective is to create an efficient platform for the delivery of large-scale affordable housing projects across Sub Saharan Africa with the initial focus in markets like Kenya, Rwanda, Nigeria and Ghana where SHAF has an existing project pipeline.

Each company is expected to play a role in this partnership; CITICC will undertake to leverage resources to conduct feasibility studies, cost analysis and overall project planning as well as mobilize the necessary financing through its banking relationships. It also looks to act as the Engineering Procurement Construction contractor for each project, subject to consent of all parties.

IFC on its part will engage to provide or mobilize construction or mortgage financing on its own or through liaising with other financial institution and Shelter Afrique is expected to leverage its existing resources to source qualified projects and identify the local partners.

It will be recalled that Shelter Afrique had signed an MOU earlier in the year with Zamfara State. This brings the number of such agreements to two; showing Shelter Afrique’s strong commitment to building lasting partnerships.

The Managing Director, Mr. Alassane Ba expressed his pleasure and delight at the beginning of a strong partnership with CITIC and his hope that the agreement will add value to Shelter Afrique in achieving its objectives.

He also added that Shelter Afrique has a vision which it is close to realising and without strong partnerships like the one with CITICC Shelter Afrique will not be able to achieve its vision.

For his part, Mr. Xu Mingguang congratulated Shelter Afrique and expressed his pleasure and honour at signing the MOU and declared that it was an honour he was sharing with all members of the CITIC family; he also commended Shelter Afrique for doing an excellent job in the field of social housing.